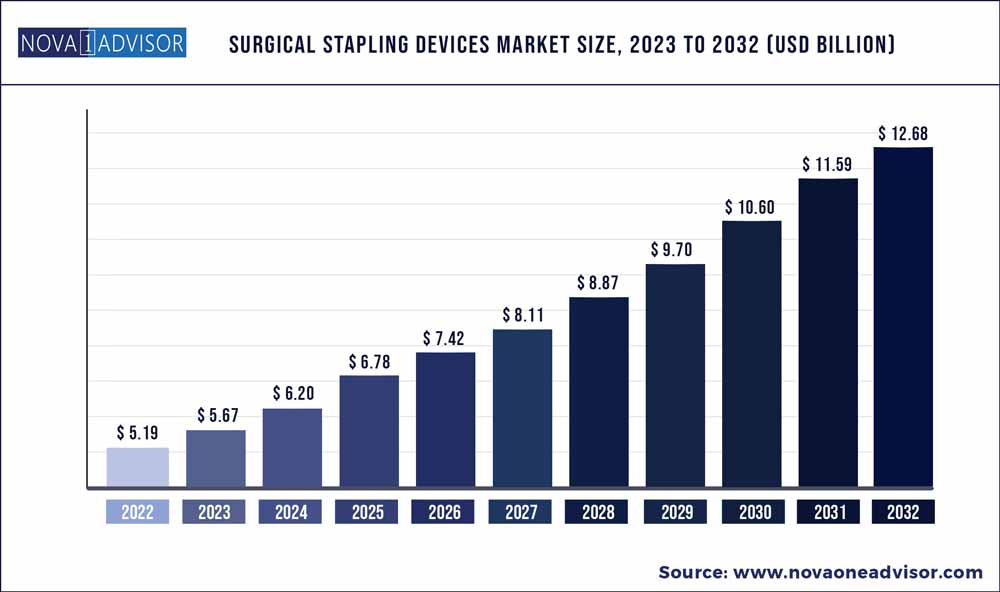

The global surgical stapling devices market size was exhibited at USD 5.19 billion in 2022 and is projected to hit around USD 12.68 billion by 2032, growing at a CAGR of 9.34% during the forecast period 2023 to 2032.

Key Pointers:

Surgical Stapling Devices Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 5.67 Billion |

| Market Size by 2032 | USD 12.68 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.34% |

| Base year | 2022 |

| Forecast period | 2023 to 2032 |

| Segments covered | Product, Type, End-use |

| Regional scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled | HAAG-STREIT GROUP; Olympus Corp.; Leica Microsystems; B. Braun Melsungen Inc.; Accurate Surgical & Scientific Instruments Corp.; Surtex Instruments Ltd.; Scanlan International; Carl Zeiss AG; KLS Martin Group; Topcon Corp.; Integra LifeSciences |

The market is expected to exhibit lucrative growth opportunities in the coming years owing to the increasing preference for staples over sutures. With technological advances, several market players are commercializing staplers used for endoscopic surgeries. These devices find applications across various branches of medicine, such as gynecology, thoracic, and gastrointestinal-related surgeries as well as tissue & wound management procedures. The demand for surgical stapling is expected to increase owing to the rise in bariatric procedures and implementation of advanced technology to perform endoscopic procedures. In addition, the introduction of powered surgical devices and growing need for tissue & wound management would further support the market growth and acceptance of surgical staplers.

Initially, sutures were widely used for wound closure surgeries. However, the introduction of staples has gradually outpaced the suture market due to the several advantages. Apart from being a tedious process, sutured sites may exhibit wound leakage and separation, whereas surgical staplers offer better speed, accuracy, and efficient wound closure.

With technological advancements, several market players are commercializing staplers used for endoscopic surgeries. These devices find application across various branches of medicine, such as gynaecology, thoracic, gastrointestinal-related surgeries, and tissue & wound management procedures.

Moreover, in developing countries, such as India and China, surgical staplers are widely used for bariatric surgeries. Covidien plc and Ethicon Endo-Surgery, Inc. offering titanium stomach staples, reported that obesity-related surgeries in India have doubled in 2013, and hence, the number of bariatric procedures has increased in the country.

North America held the largest market share owing to the use of advanced technologies and non-invasive methods in the increasing number of total surgeries performed. Other reasons for huge market share are the highest obesity rate in this region, the local presence of global players, and FDA approval for non-invasive surgeries. With recent developments in minimally invasive surgeries, special devices are designed for laparoscopic and thoracoscopic surgeries, which includes the use of surgical stapling. It has become the responsibility of surgeons to acquire the prerequisite knowledge of stapling devices

Asia Pacific is the fastest growing market with a CAGR of over 9.75% due to the presence of a large patient pool in economies such as India, China, and Japan. With an increasing conduct of surgical procedures, coupled with the rising healthcare expenditure, and an increasing awareness, the demand for stapling is expected to witness a lucrative growth. Key players in the industry are also investing in this region to expand their footprints. Initiatives such as those taken by Johnson & Johnson Medical, India, to train 8,000 doctors in advanced surgical products, including non-invasive surgical staples, are expected to propel the growth of the surgical stapling devices market in the region.

Surgical Stapling Devices Market Segmentation

| By Product | By Type | By End-use |

|

|

|